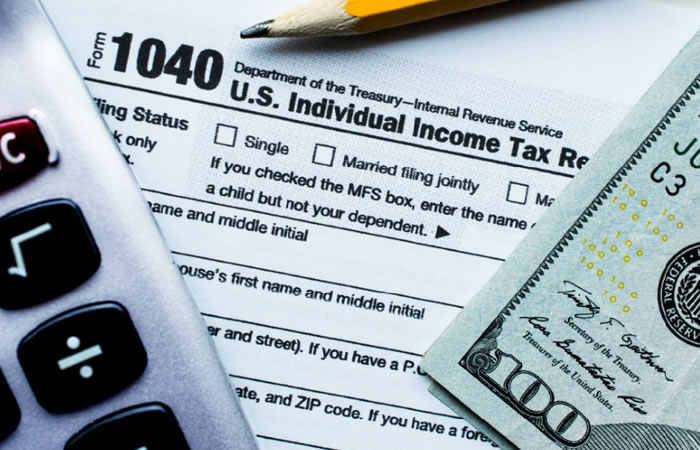

Technology Driven Tax Solutions For Everyone

Combining Security, Software, Speed and Skill make us the right partner for your tax, accounting and investment advisory needs, all under one roof.

View Services

Why CANATAX?

Tax situation of individuals vary based on their decisions. Combining this variability with numerous tax rules create complex situations. Whether it is personal or business tax preparation, our mission is help you navigate through the complexities of tax laws by incorporating technology and knowledge to provide an exceptional tax service in a friendly manner.

Strong Security

At CANATAX we value our clients' data privacy, hence our risk management framework takes the best possible measures to protect the clients' personal data.

Fast and Easy Process

Our open year around express and accurate tax preparation service makes it a quick tick off in your to do list.

Experienced Team

Quality is embedded in our DNA where our talent pool comprises of professionals who come from accounting, tax, investments, insurance, real estate and legal disciplines with the right advice to you.

Personal Tax (Resident and Non-Resident)

When it comes to personal taxes, the scenarios we generally encounter vary based on whether the individual is doing a regular job, self-employed, earns rental or investment income, or a combination of all these incomes. Learn more

Corporate Tax

A common question when starting a small business is whether to incorporate or not. We here at CANATAX will support you on this decision. This also includes all services related to your small business’ bookkeeping, accounting, tax and financial planning needs. Learn moreBookkeeping services

As a business owner you should NOT be “in the business” but “on the business” meaning outsourcing ancillary activities such as accounting & payroll to focus more on core business strategy and growth. Learn more